Burger King recently ran into a surprising problem: it ran out of burgers.

Well, not exactly. The restaurant still had plenty of ground beef and other traditional ingredients on hand, but at the end of June, the burger chain was running low on the new, meatless burgers from Beyond Meat that had been added to its menu last year, according to The Wall Street Journal.

What’s changing? Consumers.

And Burger King wasn’t alone. Burger chain White Castle, which added Impossible Foods’ meatless burgers last year, reported similar shortages, as did restaurants including TGI Fridays, Del Taco, CKE Restaurant Holdings’ Carl’s Jr., Red Robin, and others.

That’s right, consumer demand for alternative meat products has officially arrived.

In fact, White Castle leadership credited the 4 percentage point increase in same-store sales to its Impossible Sliders. As of this spring, a full 15% of U.S. restaurants offered meatless products, according to market research firm Technomic, accounting for nearly 20,000 locations nationwide, a figure that was up 3% year-over-year.

Younger shoppers, in particular, are looking for healthier, more sustainable alternatives to the usual meat-and-potatoes menus of their parents’ and grandparents’ generations. According to Technomic, 71% of consumers now eat seafood at least once a month and 50% eat vegetarian or vegan dishes at least once a month. Meatless burgers and other alternative proteins are one way for restaurants to reach these diners.

This desire for flexibility highlights the fact that dietary lifestyle choices are often not all-or-nothing decisions for consumers…Semi-vegetarian and flexitarian diets appeal to those who aspire to eat healthier while still providing leeway to splurge on meat or seafood occasionally. To cater to shifting behaviors, operators can offer protein substitutes for certain dishes or create a handful of build-your-own options that give consumers an even greater level of control.

– Bret Yonke, Manager of Consumer Insights at Technomic

These findings line up with what Chris Kerr, Chief Investment Officer with New Crop Capital, a venture capital fund focused on investing in plant-based alternative protein technologies, has been seeing on an anecdotal basis in the market for the last year-plus. In Kerr’s view, it all comes down to awareness, price, taste and convenience, and we’ve reached the tipping point on all four.

R&D advancements in recent years have led to massive improvements in alternative protein taste and texture. That’s attracted new investment capital to support marketing and product design efforts. And that has brought about new consumer awareness and interest.

“It’s just a self-feeding loop that is basically allowing all this to happen,” Kerr says. “What it’s demonstrating is that there’s all this pent up demand, and now that all of these dollars are finding their way into the market it’s bringing in more attention and the large food companies are playing a role in [alternative proteins] in a way that they haven’t for the last 50 years.”

And that fact matters a lot, because the leading global food providers are large, diversified corporations that can make or break new markets like these.

Consumers demand taste and variety

Buyers today are more concerned about their health, more socially conscious and aware of where their food comes from. Because of this, they are more accepting of alternatives to meat, dairy, eggs and other proteins than previous generations as a result. However, taste is still king, and without it, these products won’t succeed.

Explains Kerr, “If taste doesn’t drive this, everything else fails. I think what’s really happened is that companies like Beyond Meat and Impossible Foods have convinced people that they don’t have to settle for plain old quinoa burgers anymore.”

It’s not that there’s a huge new population becoming vegan. According to Gallup, less than 10% of Americans adhere to either a vegetarian or vegan diet and those numbers have been steady for years. But what has changed is a new acceptance of alternative proteins in the marketplace.

“Many people today are embracing this idea that we don’t have to eat meat as our sole source of protein,” says Kerr, “and I think that’s the real driver behind what’s going on right now. From gay rights to cannabis, a lot of social stigmas have changed, and I see plant-based eating right in there as well. That wasn’t the case even five years ago. That’s the tipping point.”

A growing market

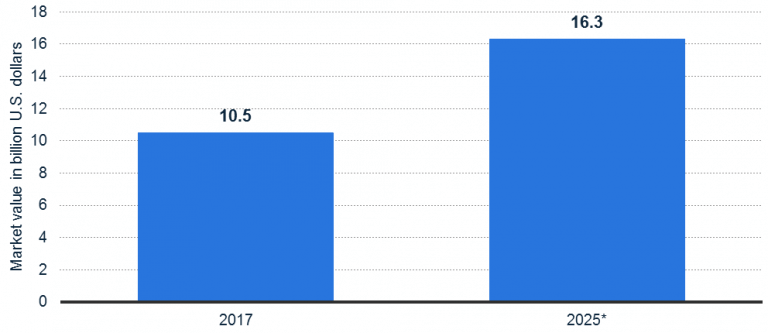

Of course, there’s far more to the alternative protein space than just well-known names like Beyond Meat and Impossible Foods. A fast growing segment, the plant protein market value is expected to grow 55% in just six years, according to Persistence Market Research.

For one thing, established industry players like Tyson and Cargill have gotten into the game, as well. Tyson Foods recently announced their plans to start selling pea protein nuggets this year, in addition to a blended pea and beef burger, potentially bringing alternative proteins to a huge new market. Cargill has invested in lab-grown meat startup Memphis Meats, pea protein producer PURIS, and Calysta, which is developing methane-based proteins. Even Ikea, the Swedish purveyor of flat-packet furniture, is getting into the game with a new plant-based version of their iconic Swedish meatballs.

The science behind alternative protein technology is far from a new development, considering that companies like Kraft and Kellogg have been selling for years. But it is only now finding broad consumer reach and appeal thanks to a range of new developments and innovations.

Atlantic Natural Foods, the manufacturer of Loma Linda®, Neat® and Kaffree Roma™ brand products, produces alternatives for seafood, beef and pork products. The company aims to create affordable, sustainable and healthy sources of plant-based protein, with a focus not only on what today’s shoppers are looking for, but also what is driving future trends.

Laura Lapp, innovation brand manager explains:

Plants are remarkable in the way the texture, size and shape can be made to mimic traditionally animal-based foods. We’ve gotten really creative with soy and have now produced what looks just like conventional tuna. We’re using real seaweed too, which has the flavor of the ocean, but doesn’t harm the ocean.

Equinom, an Israeli seed-breeding company, is working a step up the alternative proteins supply chain, breeding various grain crops with an eye toward bringing better protein to the world. While it used to focus on crops for feed and biodiesel, it has turned its eye toward human health. Currently, it is working to create 50% more protein from already high protein crops, such as soybeans, pea, sesame and chickpeas. Others that have potential are cowpeas, green peas, mung beans, and quinoa.

“We believe we could reduce the cost of plant-protein also as a viable cost-effective alternative to meat protein with better taste and functionality,” Dana says. “We want to make it clear to the market that plant protein are here to stay and this is not a trend.”

Looking ahead

In such a fast-moving industry, we’ll continue to see many players challenging the alternative protein space. For instance, did you know you can create protein out of thin air? It sounds impossible, but clean tech experts from Finland, Solar Foods can build edible proteins with just CO2, electricity, and water!

At the end of the day, the market for alternative proteins is facing a perfect storm event – product quality has reached a point where even meat eaters are looking at plant-based proteins as tasty options, interest in health and wellness have moved front and center for many buyers, and demand for protein in all forms continues to rise worldwide along with rising standards of living. The challenge is aligning the resources, along with the manufacturing and distribution capabilities, to make it all a reality.

The Bottom Line:

Consumer results are in and they are looking for tasty new protein options. With this increased demand for protein variety, we can expect to see a lot of emerging players in this new sector of the food system. The challenge will be how the supply chain is streamlined to keep up with growing consumer desires – and a growing population.

Tim Sprinkle is a writer and editor based in Denver, Colorado. whose work has appeared in Wired, The Atlantic, Entrepreneur and many other national publications. He is also the author of “Screw the Valley: A Coast-to-Coast Tour of America’s New Tech Startup Landscape.”

Tim Sprinkle is a writer and editor based in Denver, Colorado, whose work has appeared in Wired, The Atlantic, Entrepreneur and many other national publications. He is also the author of “Screw the Valley: A Coast-to-Coast Tour of America’s New Tech Startup Landscape”

This article is published as part of a partnership with Dirt to Dinner, which can be followed on Twitter @Dirt_To_Dinner